Mergers and Acquisition Homework Help For USA Scholars

Mergers and acquisitions are the areas where every scholar frequently requires the Mergers and Acquisitions Assignment Help. This can be said on the basis that mergers & acquisitions are an extremely wide-ranging topic. The students require the help of professional accounting assignment writers who have a familiarity with mergers and acquisitions both useful and theoretical familiarity. Any corporation or companies whenever they head for mergers or acquisitions, they plan for higher revenue, a lower payment, or a lowering of the price of capital. The fundamental idea behind any merger and acquisitions is a brighter prospect for the corporation; therefore the scholars who study these subjects are given the assignments and review so that they also think in this line of thought.

Thus the scholars need an expert writer who has familiarity with mergers and acquisitions, has been a part of the strategy, and tasted success and even breakdown at times. These people are the most excellent which can help the scholars with Mergers and Acquisitions Assignment Help in understanding the topic. This is an area of business finance where the students need more practical knowledge. Considering from the scholar’s point of view, they can’t approach the expert of mergers mad acquisitions frankly for help. Nevertheless, scholars now have the alternative of online sites. The online assignment helping sites gives the students the possibility to acquire the help of specialist professionals.

I am always excited to help a student with their homework. Students from across USA come to us and ask, “Can you do my assignment for me in USA?” It’s always a pleasure to help students with their homework. We love being able make an impact on the lives of young adults, helping them develop skills that are going be necessary for success in life.

Take Mergers And Acquisitions Assignment Help today!

Mergers And Acquisitions:- Overview

It’s not enough to merely survive in the cutthroat world of business. Companies on a growth path will take away market share from competitors, create economic profits and provide returns to shareholders while those that do not grow to tend to stagnate or worse – become irrelevant through exclusion

‘Mergers & Acquisitions’, as an engine for both sides of this cycle ( enable strong companies faster than the competition) ensures entrepreneurs rewards for their efforts; but also serves its crucial role by helping weaker players catch up before they are consumed completely. A company needs to grow or die. If it doesn’t, the market will take away its customers and reduce its share price until it’s gone entirely – which could happen very quickly if there are no growth opportunities available in this stagnant environment for businesses like yours.

Mergers and acquisitions are a vital part of any healthy economy, but they’re also the primary way that companies can provide returns for owners. This opportunity combined with potential large payouts makes M&A highly attractive – even more so when you consider how many entrepreneurs are looking to capitalize on their success by taking advantage of these deals nowadays.

In the last 40 years, companies have been restructured and bought or merged in order to continue operations. The most recent wave started at a time when macroeconomic conditions were improving and several key trends began developing–this trend has only grown since then with more Mergers And Acquisitions activity were seen today than ever before.

Reasons for Acquisition:

- Economies to scale and scope: A company’s size can have a lot to do with how they operate and what kind of business it is. For example, larger businesses may enjoy economies for scale because bigger companies are able to produce goods in higher volumes than smaller ones without having much overhead cost or risk associated with production while still generating profit due largely from increased efficiency at lower costs per unit sold (e). They also benefit greatly through saving on related marketing efforts such as distribution which helps them reach more customers overall.

- Vertical Integration: A company may want to vertically integrate when it concludes that a product’s materials need more direct control in order for the production cycle of an enhanced version. For example, if one producer has knowledge on what ingredients are needed but not how they’ll be used and another does not have any say over its distribution channels then this would allow them both opportunities by merging together into one organization where each party still gets their own tasks fulfilled but can work better as part-time employees rather than full time because there is less risk involved with such small jobs given offshoring trends nowadays.

- Expertise: Firms often need expertise in particular areas to compete more efficiently. Faced with this situation, a firm can enter the labor market and attempt to hire personnel with the required skills or they could purchase an already functioning unit for their needs by acquiring another company that specializes in developing talent. Firms are constantly looking for new ways on how they can stay competitive within markets but most of these solutions come at some cost such as manpower which results in higher costs per employee than if you had hired people internally from your organization’s existing pool; however, there’s also an option where instead of focusing solely hiring experienced workers directly might be very difficult because finding “the right person” takes time before anyone knows whether he/she will work out well.

- Monopoly Gains: Merger and acquisition (M&A) are often debated in the business world. The idea of merging with or acquiring a major rival can reduce competition within an industry, which leads to higher profits for firms involved; however society as whole bears the cost if such activity occurs unchecked by antitrust laws.

Need Mergers And Acquisitions Assignment Help Instantly ? Hire Expert Writers Now

Problems faced By Students in writing Mergers And Acquisitions Homework

Mergers and acquisitions are a very significant aspect of business finance. In the corporate globe, one can frequently hear the news about the merger and acquisitions. Consequently, the scholar studying corporate finance has to essentially study this area and be a professional in it. To make the students aware of the concept, colleges and universities provide the students with the coursework of mergers and acquisitions. The motive behind giving the homework is to make the students study the concepts in detail. The more students will study the topic; the more they will be capable of remembering it. But for scholars, it is not a simple task to solve the coursework of mergers and acquisitions. The motive is that the merger and acquisitions are not a limited concept, in fact, it is an extremely extensive concept.

The expert of the subject who take the choice of merger and acquisition shave to themselves do lots of study before reaching to the conclusion so that one can recognize the difficulty of the subject. The scholars have to, therefore, recognize the kind of mergers; there is a diverse type of mergers depending upon the forms, economic perspective, and lawful perspective. The mergers and acquisitions are preceded and succeeded by a number of factors to make sure the smooth process and thus in the best possible interest of the corporation. Hence the students must recognize these concepts and their insinuations. The scholars are given the case studies which need the students to have an exhaustive familiarity about the concepts. If you are facing problems with your Mergers and Acquisitions homework, don’t worry come to us and get finance assignment help from our professional writers.

Get Help with your Mergers And Acquisitions Assignment

We offer assistance with any kind of finance topic including mergers and acquisitions assignment help or help with report writing. Our guidance extends to test preparation, research paper support, and individual tutoring. Practice exams, smart boards, and other interactive devices are just several of the tools available to help your learning process. When you utilize, our do my homework online service for finance assignment help you are getting the top assistance available.

Mergers and Acquisitions tutors at Students Assignment Help are capable specialists with large familiarity in assignment resolving, mentor & research study. They are well aware and knowledgeable of the numerous ideas of Mergers and Acquisitions and their use. We take all the needs and requirements into factors to consider before resolving an assignment to lessen all types of mistakes. Our Mergers and Acquisitions homework help experts in the USA who are outstanding in their particular fields with knowledge of fixing more than a thousand tasks. Mergers and Acquisitions professionals utilize charts, tables, and efficient information to make the alternative nicer. It assists to understand the idea much better and improve your grades at school or college. Pay for college assignments help at very affordable rates in the USA.

With Students assignment help you can avail yourself of high-quality essay writing help for Quaternary science as our Quaternary science assignment writers are capable of guiding medical students to write a well-researched paper on this subject. Additionally one can also avail case study writing support of high quality and well-formatted.

Get Custom Mergers And Acquisitions Assignment Help Online. Hire USA Experts

Reasons for Considering Us

- Our professional-quality faculties: we take particular care of hiring only the skilled and expert assignment helpers for our students. We believe that top solutions can be given only by experts who are why we have assembled the best team of teachers and professors for you.

- High-quality, comprehensive solutions: the solutions that we provided are completely error-free. You will not get any grammatical or spelling mistakes as we take particular care of proofreading twice. Plus, we also offer explanations along with diagrams, tables, charts, and whatever else is necessary for a good explanation.

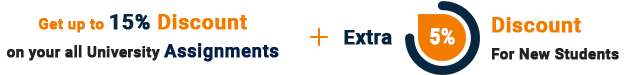

- Low cost: we at Students Assignment Help have kept the fees extremely nominal that any student can effortlessly afford.

- In-time delivery: we try our very best to deliver the solutions much before the time limit. We do not compromise on the excellence of solutions only because we need to deliver them much before the deadline. Remember to get in touch with us anytime you desire whenever you require guidance on any topics such as Valuation of Fixed Assets Assignments, Capital Gains Tax Assignment, CashFlow Statement Assignment, and many more.