Managerial Accounting Assignment MID TERM EXAM | Universiti Tun Abdul Razak

Looking for Plagiarism free Answers for your US, UK, Singapore college/ university Assignments.

| University | Universiti Tun Abdul Razak (UniRazak) |

| Subject | Managerial Accounting |

INSTRUCTION TO CANDIDATE:

- Please read the instructions given in the question paper

- There are FOUR (4) questions in this question paper. Answer ALL

- This mid-semester exam contributes 20% of your total marks.

TOTAL: 60 marks

QUESTION 1

A. Briefly distinguish between managerial accounting and financial accounting. Be sure to comment on the general focus, users, and regulation related to the two fields.

(5 marks)

B. For each of the following, identify and state the relevant accounting concepts.

- An accounting principle that indicates that an organisation is viewed as a unit independent from its owner.

- An Accounting principle requiring costs necessary for the generation of revenue are compared (offset) against the revenues in the determination of periodic net income.

- Accounting is only concerned with the recording of facts that can be expressed in monetary terms, as opposed to using physical or time units of measurements.

- The cost of a dustbin in an office is treated as a period expense rather than depreciating its cost over its useful life.

- Business premises are shown on the statement of financial position as RM100,000, its original cost 10 years ago, although its current value is RM2,500,000.

- Expenses are recognized in the same period as the revenue which results from the incurrence of these expenses.

- Generally, a business is assumed to have an indefinite life, unless there is evidence to indicate otherwise.

- The financial statements of a business report the economic activities of the business only and do not include the economic activities of the owner of the business.

- An accountant generally recognizes losses when there is evidence to indicate a high probability of the losses occurring, but gains are not recognized until they are actually realized.

- An accounting concept that requires an entity to give the same accounting treatment to similar events in successive accounting periods. (10 marks)

(Total: 15 Marks)

Flexible Rates Compatible With Everyone’s Budget

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

QUESTION 2

Impact & Associates is an interior decorating firm in Kuala Lumpur. The following costs were incurred in a project to redecorate the mayor’s offices:

Direct material RM 29,000

Direct professional labor 42,000

The firm’s budget for the year included the following estimates:

Budgeted overhead RM800,000

Budgeted direct professional labor 640,000

Overhead is applied to contracts by using a predetermined overhead rate that is based on direct professional labor cost. Actual professional labor during the year was RM655,000 and actual overhead was RM793,000.

Required:

- Determine the total cost to redecorate the mayor’s offices. (4 marks)

- Calculate the under- or overapplied overhead for the year. (3 marks)

- Operation costing is a popular type of accounting system, one that combines selected features of job-order and process-cost accounting. Briefly discuss the basic features that are associated with an operation-costing system with ONE (1) example.

(3 marks)

(Total: 10 Marks)

QUESTION 3

The following information pertains to Zifa Sdn Bhd (ZSB) for the previous financial year.

Beginning inventory in units 5,000

Units produced 25,000

Units sold 28,000

Costs per unit:

Direct materials RM7.00

Direct labor RM4.00

Variable overhead RM1.50

Variable selling expenses RM3,000

Fixed manufacturing overhead RM83,000

Fixed selling and administrative expenses RM3,000

Assume that the selling price is RM20 per unit.

Required:

(a) Calculate the product cost per unit using the Variable Costing System and Absorption Costing System. (5 marks)

(b) Prepare the income statement for both the Variable Costing System and the Absorption Costing System. (15 marks)

(Total: 20 Marks)

QUESTION 4

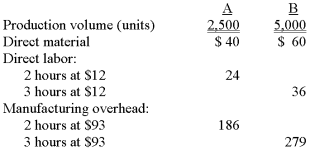

Nelly Industries manufactures two products: A and B. A review of the company’s accounting records revealed the following per-unit costs and production volumes:

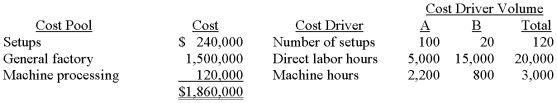

Manufacturing overhead is currently computed by spreading overhead of RM1,860,000 over 20,000 direct labor hours. Management is considering a shift to activity-based costing in an effort to improve the firm’s accounting procedures, and the following data are available:

Nelly determines selling prices by adding 40% to a product’s total cost.

Note: Assume all $ are in RM

Required:

A. Compute the per-unit cost and selling price of product B by using Nelly’s current costing procedures.

(2 marks)

B. Compute the per-unit overhead cost of product B if the company switches to activity-based costing.

(7 marks)

C. Compute B’s total per-unit cost and selling price under activity-based costing.

(2 marks)

D. Nelly has recently encountered significant international competition for product B, with considerable business being lost to very aggressive suppliers. Briefly explain whether activity-based costing allow the company to be more competitive with product B from a price perspective.

(2 marks)

E. Explain whether the cost and selling price of product A will likely increase or decrease if Nelly changes to activity-based costing. Hint: No calculations are necessary.

(2 marks)

Total: 15 Marks)

Flexible Rates Compatible With Everyone’s Budget

Hire a writer to get plagiarism free assignment answers of this question

Looking for Plagiarism free Answers for your US, UK, Singapore college/ university Assignments.