FINA3307 Trading in Securities Markets Assignment Revision Questions | UWA

Looking for Plagiarism free Answers for your US, UK, Singapore college/ university Assignments.

| University | The University of Western Australia (UWA) |

| Subject | FINA3307 Trading in Securities Markets |

REVISION QUESTIONS FOR WEEKS 04 – 06

1 Week 4 Price Formation Process

- In their race to profit, informed traders often duplicate their research efforts. Since research is often very expensive, these duplicate efforts suggest that the competition among informed traders creates economic inefficiencies. Should informed traders collude to lower their costs? Would their collusion make prices more efficient?

- What are the differences between the traditional and market microstructure definition of market efficiency? Explain the trade-off between market liquidity and market efficiency.

2 Week 5 Adverse Selection, Bid Ask Spread

- The statistical study by Barclay and Warner (1993) found that very small trades and very large trades did not have a significant impact on stock prices. They found that medium sized trades had the greatest impact on the security process. Describe how this empirical finding might be consistent with the theoretical results of Kyle (1985). This question is from Chapter 5 Exercises.

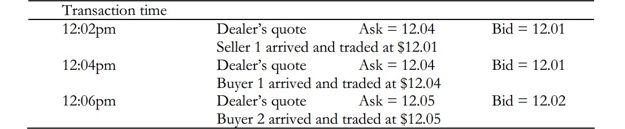

- You observe the following quote revisions of a dealer before each trade.

a. Discuss the inference you could make regarding the “informativeness” of Seller 1 and Buyer 1.

b. Calculate the dealer’s adjustment for adverse selection.

- Suppose that dealer inventory costs are the sole source of the dealer spread. Further suppose that a transaction was executed at the bid. Would subsequent bid and offer quotes tend to be higher or lower? Why? Now, suppose that a transaction as executed at the offer. Would subsequent bid and offer quotes tend to be higher or lower? Why? In either scenario, would transaction prices tend to exhibit positive, negative, or zero autocorrelation? Why?

3 Week 6 Institutional Trading

- Suppose that you are a trader at a large trading firm. You have just received a sell order from a mutual fund for 1 million shares of stock that has an average daily volume of 250,000 shares. What alternatives do you have to complete this client order by the end of the trading day?

- Discuss the dilemma that institutional traders face when deciding the optimal level of transparency in the market that is best for their trading.

- Ticker EAS is traded on the Gulf, Pacific and Atlantic stock Exchanges. The sequence of bids in the consolidated record is:

| Time | Exchange | Bid |

| 10:00:01 | Atlantic | 23.33 |

| 10:00:02 | Pacific | 23.32 |

| 10:00:03 | Gulf | 23.34 |

| 10:00:04 | Pacific | 23.40 |

| 10:00:05 | Gulf | 23.45 |

| 10:00:06 | Pacific | 23.44 |

| 10:00:07 | Atlantic | 23.43 |

| 10:00:08 | Gulf | 23.40 |

Construct the NBB at each time.

- What are the temporary and permanent price effects of block trading?

a. Given the following transaction records, decide which trades are likely to be classified as blocks.

b. Compute the temporary and permanent price effects of two block trades [you can calculate the change in price by using continuous returns, i.e., ln(Pt – Pt-k)].

| Date | Time | Side | Trade Price | Trade Size (number of shares) |

| 19/07/20XX | 10:09 | A | $9.50 | 500 |

| 19/07/20XX | 10:50 | B | $9.75 | 115 |

| 19/07/20XX | 11:35 | B | $9.80 | 200 |

| 19/07/20XX | 12:23 | A | $9.40 | 10,500 |

| 19/07/20XX | 12:50 | B | $9.65 | 180 |

| … | … | … | … | … |

| 20/07/20XX | 11:35 | B | $10.08 | 500 |

| 20/07/20XX | 12:53 | A | $10.05 | 1,000 |

| 20/07/20XX | 13:14 | B | $10.55 | 9,000 |

| 20/07/20XX | 13:54 | B | $10.45 | 450 |

Flexible Rates Compatible With Everyone’s Budget

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Looking for Plagiarism free Answers for your US, UK, Singapore college/ university Assignments.