Free Sample assignment on Customs – Regulatory Compliance Management

Introduction

The role of custom is to implement the wide range of border management policies on behalf of government agencies. The role and responsibility of customs administration vary from country to country. The responsibilities of custom are revenue collection, trade compliance and facilitation, interdiction of prohibited substances, cultural heritage protection and enforcement of intellectual property law. The international bodies such as the World Trade Organisation and World Customs Organisation recognise the changing nature of border management and response through development of global standards.

For last few decades there is high pressure from international bodies to minimise government intervention in the commercial transaction. Moreover, the current trend is increasing expectation for customs authorities across the world to emphasis on facilitation of trade. Traditionally the role of customs has been of ‘gatekeeper’ through which international trade must pass so as to protect the interest of the nation. Hence, the role of custom has changed significantly by the advent of technological advances, increasing globalisation of trade and revolutionary factors such as 91/11 terrorist attacks (Wulf and Sokol 2005).

Flexible Rates Compatible With Everyone’s Budget

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

The study will focus on the customs administration of developing island country of Belmontia. The import duties and related taxes represent a significant proportion of national revenue for Belmontia. The focus for Belmontia customs authority is revenue collection. The report will propose the recommendation on new and effective approach to regulatory compliance management for Belmontia customs. The given study will analyse the problems faced by Belmontia customs and way in which the new approach will be effective in solving the issues. The proposal also identifies and incorporates international trends and standards relating to compliance management.

New and effective approach to regulatory compliance management

In recent years, the international trading environment has changed considerably in terms of speed, complexity, volume of trade, rapid technological advancement and revolution in global trading practices. Therefore, the changes have tremendously affected the working and responsibilities of customs authorities. As a consequence, it becomes essential for Bemontia customs administration to adopt and implement a disciplined approach to managing customs risk. In Belmontia, the duty and vat collected by customs department on imported goods amount to 60 percent of the total government revenue. The country is resource rich and has recently emerged from political instability. The county has huge potential of economic growth (Hoekman and Ozden 2006).

Currently, the custom ensures that the correct amount of revenue is collected as per the regulation. The department protects the trading community by prohibiting the imports of banned items in the country. The customs department ensures that exporters and importers have obtained necessary permits and licenses for certain goods. Although the country is emerging as a major trading nation within its geographic region and good Customs Regulatory Compliance Management, the country fails to achieve balance between trade facilitation and regulatory controls (Hoekman and Ozden 2006).

Therefore, preparation of appropriate legislative framework is the essential element of any regulatory regime. Custom and tax administration have a responsibility to comply with the statutory provision of law. The customs administration should move away from the traditional gatekeeper risk-averse style to a more risk-based compliance management approach (Hoekman and Ozden 2006).

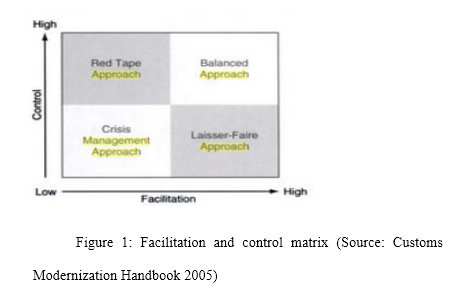

The two common objectives of custom are trade facilitation and control. It is important for the country to achieve a balance between trade facilitation and control.

The two risk face by country is failure to facilitate international trade and potential failure for noncompliance with customs laws. Therefore through application of risk management principle the country can achieve an appropriate balance between objectives. Currently, the customs compliance management runs on a flawed assumption. It is assumed in the administration that the only way to facilitate the process is through decreasing the level of control ((Wulf and Sokol 2005).

As depicted in figure 1, the concept of facilitation and control are two distinct variables.

The top left quadrant of facilitation and control matrix represent a red tape approach. It shows high control regulatory regime in which customs requirements are strict. In red tape approach, the level of control is the strong factor of determining facilitation. The approach represents a risk-averse management style. However, in modern society the red tape approach is likely to attract criticism and complaint, as the increase in expectation of community to minimize customs intervention.

The bottom left quadrant representing low control and low facilitation depicts crisis management approach. The administration adopting crisis management approach exercise little control and simultaneously achieves little facilitation. The approach benefits are neither trading community nor the government. The bottom right quadrant depicts the laisser-faire approach in which high facilitation and low control are exercised. It is the appropriate approach of managing compliance in which there is no threat and risk of government on non-compliance of customs procedures. Lastly, the top right quadrant represents a high regulatory control and high trade facilitation. It is referred as the balanced approach. The balanced approach maximise the benefits to both international trading community and customs. Hence, administration should seek to achieve a balanced approach (Wulf and Sokol 2005).

The important role of custom is to manage compliance with the regulator that ensures facilitation of trade. The key to achieving a balance between facilitation and control are effective application of risk management principles. As the appropriate balance between facilitation and control are achieved the use of risk management becomes effective. The risk management approach focuses on the identification of potentially high risk areas and directing resources towards such areas. The intervention is minimal in low-risk areas. The regulatory regime adopting risk strategies break the nexus between control over goods and revenue liability of trader. It permits customs clearance before the arrival of cargo (Wulf and Sokol 2005).

The underlying elements of risk based compliance management strategy are compared with tradition gatekeeper risk management style of compliance. The WCO, through the revised provisions of Kyoto Convention, has made an attempt to achieve a universal adoption of risk managed style. Under gatekeeper style payment of duties and taxes is the prerequisites requirement of customs clearance. The elements of each style of compliance management is grouped into four categories, i.e., the legislative framework of the country, the administrative framework of country customs organisation, risk management framework and the technological advancement framework.

The four categories are the determining factor in which the movement of cargo is expedite across country borders and the way customs control is exercise on arrival of cargo. The risk base compliance management approach provides a legislative framework that allows necessary basis in law for the achievement of the range of administrative and risk management strategies. The risk management style of legislative provides flexibility and customised solution that enables implementation of relevant risk management and administrative strategies. The risk approach recognises responsibilities of both government and trading in achieving regulatory compliance. The risk based approach allows administration to prepare the strategy depending upon the level of risk (Customs Partnership: A two way street 2005).

The traditional gatekeeper style focuses on ‘one size for all’ compliance strategy. The risk-based approach balances between regulatory control and trade facilitation. The main focus of risk style is on dual enforcement and client service. A risk based approach is consultative and cooperative approach while the traditional style focuses on unilateral approach. The risk management approach focuses on assessing the integrity of trade systems and customs while the gatekeeper style focuses on assessing the nature of transactions (Customs Partnership: A two way street 2005).

The risk approach employs flexible procedures and administrative discretion. The focus of risk base approach is on post-transaction compliance assessment. The risk compliance management approach is an effective appeal mechanism. Traditional gatekeeper risk management framework runs on the principle of indiscriminate intervention or 100 percent check whereas risk approach focuses on high risk area and minimal intervention in low-risk areas.

The risk-based approach gives pre-approval report clearance on arrival of cargo gods. The adoption of traditional gatekeeper style results in pending revenue payment because of high maintenance of physical control. The management of risk-based approach breaks the nexus between physical control and revenue liability. The risk approach also rewards for recognised compliers. Lastly the technology framework act as an enabler that enhances the ability of administration to adopt risk management style (Customs Partnership: A two way street 2005).

The prerequisites requirement of risk approach is appropriate communication and information technology infrastructure. The IT framework provides automated processing and clearance arrangements. The risk approach allows regulators to achieve maximum integration with commercial systems. Hence, the risk base approach proposed by the Kyoto Convention provides transparency and predictability for all those linked in international trade. The approach meets the needs of international trade and customs authorities for facilitation of customs procedures.

It ensures establishment of appropriate standards and control. The approach ensures that simplified and harmonized principles are made obligatory on contacting parties. Lastly, the risk approach allows customs authorities to respond to changing business and administrative methods (International trade facilitation: the custom imperative 2012).

Application of approach to resolve problem faced by Belmontia

In recent years, Belmontia has realized the importance of trade to achieve sustainable economic growth. Accordingly, the country has a lower tariff, establishes regulatory regimes to facilitate trade and explores opportunities for greater regional integration. The progress in trade facilitation is slow in Belmontia. The progress is hampered because of the high cost and administrative difficulties at the port. The outdated bureaucratic border customs clearance process is the bottleneck in the economic growth. The poor infrastructure and cumbersome systems increase transaction costs and make delays to the clearance of import, export and transit goods. Rising cost and delay in customs processing is a major challenge faced by traders.

It also makes the country less competitive and less attractive for foreign investment. The ineffective customs management leads to the creation of opportunities for administrative corruption. Hence, there is a need for effective regulatory control that balances the need to facilitating legitimate trade through better customs management. The clearance time and delay in collection of revenue is the weakest line in the border processing chain (McLinden, Fanta, Widdowson and Doyle 2011).

As per World Bank and IFC (2006) the excessive physical inspection and the time between accepted customs declaration and customs clearance are the major sources of delays (World Bank and IFC 2006).

Currently, Belmontia is facing many administrative and operating issues. The high level of intervention by custom authority deters economic growth of the country. The improvement in facilitation of trade is the precondition by a donor providing funding for a major infrastructure project.

The risk based compliance management approach requires a holistic approach to risk management. As depicted in figure 2 the approach is an ongoing assessment of future risks for a customs administration at different stages, and compilation of result to facilitate priority setting and improved decision making. The robust organisational risk management framework empowers customs authority to make risk-based decision in a structured manner.

The effective risk management is dependent on high-level mandate and commitment from the highest level of organisation. The Director General and senior officers frame policy, objectives, authorization to plan, deployment of resources and make a decision on risk management and assessment (WCO 2013).

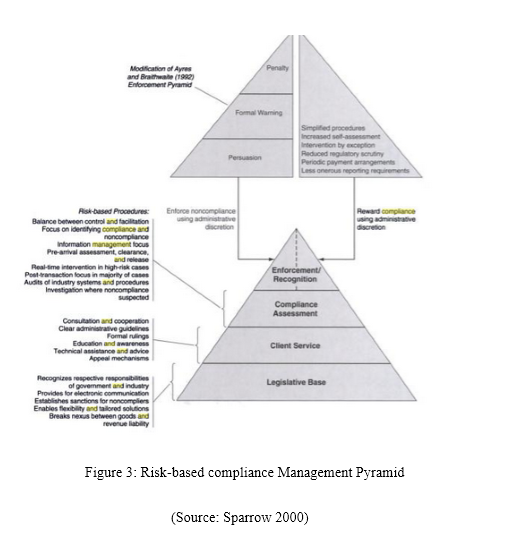

Hence, the Risk –Based Compliance Management Pyramid as depicted in Figure 3 draws various elements of a risk management style. It is a structured and logical approach to the management of compliance. The main objective of the framework is to achieve a balance among various types of risk-based strategies including self-assessment strategy, to effectively manage compliance. The fundamental principle of Risk-based compliance approach focuses on the need to provide trading sector with the ability to abide by customs requirements.

As shown in figure 3, the first tier of the pyramid is establishment of effective legislative base to ensure compliance of customs requirement by commercial sector. The second tier in the pyramid is setting of appropriate client service strategies. The client services include consultation, cooperation, establishment of clear administrative guidelines, providing education and technical awareness. All in all, the strategies are important to provide the commercial sector achieving clarity and certainty in assessing liabilities and entitlements. The third tier risk-based pyramid is compliance assessment.

It balances between control and facilitation. The compliance assessment focuses on identifying compliance and non-compliance behaviour. The compliance assessment stage in pyramid includes elements such as risk-based physical and documentary checks, audits and investigation where non-compliance of procedure is suspected. The compliance activities determine whether the trader is following the customs law. It is important to take into account the key principle of the Revised Kyoto Convention when developing strategies for compliance assessment (Sparrow 2000).

The peak of the pyramid represents compliance strategies for non-compliers. The strategies identified for the non-compliers include number of enforcement techniques. The strategies for recognised compliers include range of self-assessment techniques, minimal regulatory scrutiny, periodic payment arrangement, less onerous reporting requirement and increase in the level of trade facilitation (Sparrow 2000).

A rigorous enforcement approach is required for the trading community who actively involved in revenue fraud.

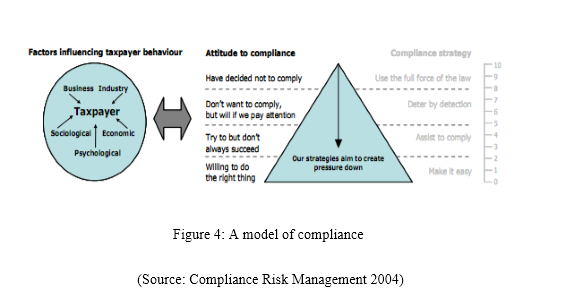

The model as shown in Figure 4 shows that the provision of ongoing assistance will be helpful to those who pay the correct amount of revenue. The model shows that the taxpayer should be educated and made aware that the customs authority detect their non-compliance and take credible enforcement action on those who have decided not to comply. The credible enforcement techniques include administrative penalties, prosecution and license revocation (in severe cases). The prerequisite tools are necessary to be possessed by revenue authority to impose a sanction on entity for non-compliance behaviour. Hence, if the model of compliance is applied consistently and appropriately, it will build community confidence in demonstrating procedural justice (Compliance Risk Management 2004).

The adoption of compliance model will resolve the issue of pending revenue payments. The effective application of the compliance model will build confidence and speed the clearance procedure. The management of revenue system not only includes audits, verification and enforcement but also requires educating and helping people to comply by the customs laws. The country should adopt differentiation strategy for managing the revenue system. Belmontia should apply stronger enforcement techniques in high risk profile markets. In the less risk profile market, the administration should focus on service, education and information.

The customs administration can resolve the issues on increasing number of complaints from traders over the time taken to clear imported goods. The reason of time processing clearance procedure is high intervention by customs. Following the principle of Revise Kyoto Convention, the trader with a good record of compliance should go through minimal level of scrutiny. Similarly, the custom should reduce its level of regulatory scrutiny and should focus on company self-assessment of compliance for a low-risk trader. It is the most effective strategy and result in simplification of customs procedures for traders.

The risk based compliance management provides a framework for situation in which low-risk trader are allowed to operate under less regulatory requirements and customs intervention. Therefore, it results in high level of trade facilitation. The high risk trader’s transactions should go through high level of customs intervention and control. The various types of customs intervention are physical examination, documentation check, audit and physical control at manufacturing premises. Hence, it can be concluded type of intervention is the basis for the level of identified risk (WCO Customs risk management Compendium 2013).

International Standards of Compliance Management

In recent years, there is high pressure from the international trading community to minimise government intervention by simplifying the legislative framework in commercial transactions. The expectations for customs authority are growing to increase emphasis on the facilitation of trade. The changing environment has dramatically impacted the way in which regulatory authority fulfil their responsibilities (A future for customs? 2010).

For several decades, the role of custom was limited to gatekeeper. Traditionally, the customs authority represents a barrier through which international trade must pass in order to protect the interest of the nation. The role of custom is changed as an intervention body to intervention based on identified risk. The international trading community changing expectation is based on its operating environment. The communities expect simplest, quickest, reliable way of doing business. The trading community seeks certainty, expectation, clarity, timeliness and reliability in dealing with government (A future for customs 2010).

The recent trend in best practice focuses on optimisation of both facilitation and control. The policy shift in client service strategies is based on differentiation and service culture. Now strong incentives are given for compliance to regulation. The new trend in regulatory compliance management facilitates extensive collaboration and information sharing between governments and trading community. The recent trend in regulatory compliance management from high level of intervention to intervention by exception is a significant business shift. The Revised Kyoto Convention has proposed business shift from transaction-based procedures to compliance-based intervention that is driven by customer analysis and segmentation through intelligence risk management (A future for customs? 2010).

The dramatic change in trading environment has result in significant changes in global trading practice and customs administration around the world. The administration is required to adapt to standard and methods of operating in order to maintain effectiveness and relevance in the world. The trade facilitation agenda has gained momentum in Doha Ministry Declaration and the general council of WTO. The international bodies have devised standards for intensifying international commitment and further expediting the movement, releasing and clearance of international traded goods.

The success of the trade agendas is based on the ability of custom to balance trade facilitation and regulatory intervention effectively. The achievement of such balance provides significant benefits for national agencies. The trade facilitation is the new issue and is added to the WTO agendas. The countries are now reassessing their legislative and administrative approach to match up with the regulation of international trade (World Economic forum 2013).

The countries like US and many other nations are benchmarking the effectiveness of US trade control against various checklist developed by recognised standards of compliance. The US recognises various international standards of compliance into an integrated checklist to assess the effectiveness of program (Pisa-Relli 2013).

The WTO has identified areas of concern at international level after following consultation with trading community. The concern areas are excessive documentation requirements, excessive manual work and insignificant use of technology, lack of transparency in import and export requirements, inadequate audit based controls and risk assessment techniques. The lack of co-operation and modernisation among government agencies is a challenge to deal effectively with the increase in trade. WTO rules set standards on the principle such as predictability, transparency, partnership and application of modern risk management techniques (World Economic forum 2013).

The issues identified by WTO are high on the agendas of World Customs Organisation. WCO is an independent government organisation headquartered in Brussels. WCO is the recognised international policy setting body on customs issues. However, in June 1999 WCO approved the revised Kyoto Convention for simplification and harmonization of customs procedures. The Revised Kyoto Convention is developed after high pressure from trading community to minimise level of customs intervention and maximising trade facilitation. As per WCO, the RKC provides a blueprint for innovative custom management practices. It is designed keeping in mind the importance of customs procedure in the world of rapid technological advancements (A future for customs 2010).

The Convention aims to promote the achievement of effective trading environment while keeping appropriate level of control across member organisation. It helps the member organisation to achieve modern customs administration by contributing to the facilitation of international trade. The RKC seeks to eliminate the divergence between customs procedures and practices that obstruct international trade. The RKC standard ensures that principles are made obligatory on member parties. The RKC ensures appropriate standards of customs control (A future for customs 2010).

The standards of RKC are consistent with the Risk base pyramid. The general principle of Convention reflects client service elements of the pyramid. One of the RKC principles proposes that customs administration should establish a consultative, cooperative relationship with the trading community for the accomplishment of effective operating methods. The RKC standards require that the relevant information pertain to public should be made readily available to public.

The standards propound that information on matters related to trading industry should be address quickly and accurately. The RKC standard gives the person the right to appeal (A future for customs 2010).

Hence, RKC hold number of standards on the way the customs authorities should perform their compliance management responsibility. The standard 1.3 of RKC, propose that custom shall maintain formal consultative and cooperative relationship with international trading community for smooth facilitation of trade.

The Standard 6.2 emphasizes on limiting the customs control to ensure compliance with Customs law. The Standard 3.6 establish provision of including audit based control in Customs control systems. As per standard 6.8 to enhance customs control the administration should seek to include Memorandum of Understanding with trade. Lastly, the standard 6.10 provides authority to Customs to evaluate the risk level of trader so as to ensure the compliance with customs requirements (World customs organisation 2002).

The revised Convention provides transparency and predictability of all those involved in international trade. The member administrations are committed to using risk management techniques, maximising application of information technology and appropriate implementation of international standards. The WCO is the first proponent who identified the need of reconsidering the traditional approach for an effective international trade control. The WCO, through the provision of RKC, aims to achieve adoption of risk managed style of regulatory compliance. The WCO state that control should be kept minimal for meeting the objective of maximising international trade and travel facilitation. The two trade facilitating agendas and standards of Revise Kyoto are fully compatible with each other in relation to legal provisions and principle in the WCO instruments (Conventions and Agreements 2014).

Indeed, it is clear indications that trade facilitation agendas are growing the concern across world. The implementation of customs procedures has impact on world trade and travel. The GATT article in the Doha Minstrel declaration provides principle on movement of goods in transit and administration of trade regulations. The instrument of WCO provides legal provisions and implementations guidelines. Through Kyoto Convention, WCO provides practical guidance and information for the implementation of standards (Conventions and Agreements 2014).

However, the supply chain security with the increase in the level of trade facilitation now consumes tighter regulatory control. The SAFE framework introduced in 2007 is a major international instrument for setting standards. The framework emphasizes on balancing security and facilitation. The WCO released Framework of Standards to Secure and Facilitate Global Trade that aims to provide a regulatory regime on security and facilitation of international trade. The WCO Framework of Standards establishes standards to maintain supply chain security and trade facilitation at global level to promote certainty. The Framework provides integrated supply chain management for various modes of transport. The main focus of the framework is on the creation of the international system that offers the high degree of guarantees in the supply chain ((Polner 2013).

Hence, it can be concluded that the role of customs management has changed because of evolutionary factors such as an increase in globalization of trade and as a result of revolutionary factors. The shift in government policies and the way these policies are administered have increased the role of customs. The international bodies such as World Trade Organisation and World Customs Organisation through development of global standards recognise the changing nature of border management.

Conclusion

It can be concluded that the custom has the significant role in ensuring global trade meets regulatory requirements and conform to legislative law of the country. Customs administration has the essential task of enforcing the law, collection of duties, taxes, providing sanctions on clearance of goods and ensuring compliance. The changes in customs operating environment and growth in trade volumes have impacted the way customs administrations are managed. The new priorities of government and emerging challenges at border level have pressured administration to seek for structured and systematic approach to managing risk.

The implementation of risk management is a critical element; therefore international bodies such as WCO, WTO have developed strategic vision, standards and guidelines for effective compliance of customs management. The increase in automation and easy availability of comprehensive information has enabled customs to improve their risk assessment techniques. The risk based customs administration aims to achieve reasonable and equitable balance between compliance and minimize intervention and cost to facilitate legitimate trade. Therefore, it is the need of the hour to adopt a holistic risk-based compliance management approach that aims to achieve the optimum level of facilitation and control. The one of the precondition of risk based compliance management approach is a robust framework of organisational risk management.

The customs administration should continually develop, monitor, review and assess their risk management practices. The administration department of customs is increasingly adopting risk management techniques. The techniques are helpful in determining the key area of risk exposure and guides on how to effectively allocate the scarce resource to manage risks.

A future for customs?. 2010. [Online]. Available at: http: https://ec.europa.eu/taxation_customs/resources/documents/customs/policy_issues/conference_events/shangai/doyle.pdf [Accessed on: 30 Oct 2014].

Compliance Risk Management. 2004. [Online]. Available at: https://www.oecd.org/site/ctpfta/37212610.pdf [Accessed on: 29 Oct 2014].

Conventions and Agreements. 2014. [Online]. Available at: https://www.wcoomd.org/en/about-us/legal-instruments/conventions.aspx [Accessed on: 30 Oct 2014].

Custom Partnership: A two way street. 2005. . [Online]. Available at: https://newcustomscentre.files.wordpress.com/2012/09/customs_partnerships_a_2_way_street.pdf [Accessed on: 29 Oct 2014].

Hoekman, B. And Ozden, C. 2006. Trade Preferences and Differential Treatment of Developing Countries. California: Edward Elgar.

International trade facilitation: the custom imperative. 2012. [Online]. Available at: https://newcustomscentre.files.wordpress.com/2012/09/international_trade_facilitation_the_customs_imperative.pdf [Accessed on: 29 Oct 2014].

McLinden, G. , Fanta, E., Widdowson, D and Doyle, T. 2011. Border Management Modernisation. Washington: The World Bank.

Pisa-Relli. 2013. Benchmarking U.S. Trade controls compliance. Toward an integrated approach. Global trade and Customs Journal, 10 (8), 312-327.Polner, M. 2013. Coordinated border management: from theory to practice. World Customs Journal, 5 (2), 49-64.

Sparrow, M. 2000. The Regulatory Craft. Washington: Brookings Institution Press.

WCO Customs risk management Compendium. 2013. [Online]. Available at: http: https://www.wcoomd.org/en/topics/enforcement-and-compliance/instruments-and-tools/~/media/B5B0004592874167857AF88FC5783063.ashx [Accessed on: 29 Oct 2014].

WCO. 2013. [Online]. Available at: https://www.wcoomd.org/en/topics/enforcement-and-compliance/instruments-and tools/~/media/45BE65FFE12748FDA6D41BA7F3451C75.ashx [Accessed on: 30 Oct 2014].

Widdowson, D. 2007. The changing role of customs: evolutions or revolutions ?. World Customs Journal, 1 (1,), 31-37.

World Bank and IFC (International Finance Corporation). 2006. Doing Business 2007: How to Reform. Washington, DC: World Bank.

World Custom Organisation. 2002. Kyoto 2000: The International Convention on the Simplification and Harmonization of Customs procedures (Revised) – Pathway to Efficiency and Effectiveness in the Customs Environment. Brussels: World Customs Organization.

World Economic Forum. 2013. Global Agenda Council on Logistics & Supply Chain Systems 2012-2014. WEF: Switzerland.

Wulf, L. And Sokol, J. 2005. Customs Modernization Handbook. Washington: World Bank Publications.